Analysis: The 2022 Kona Bike Count

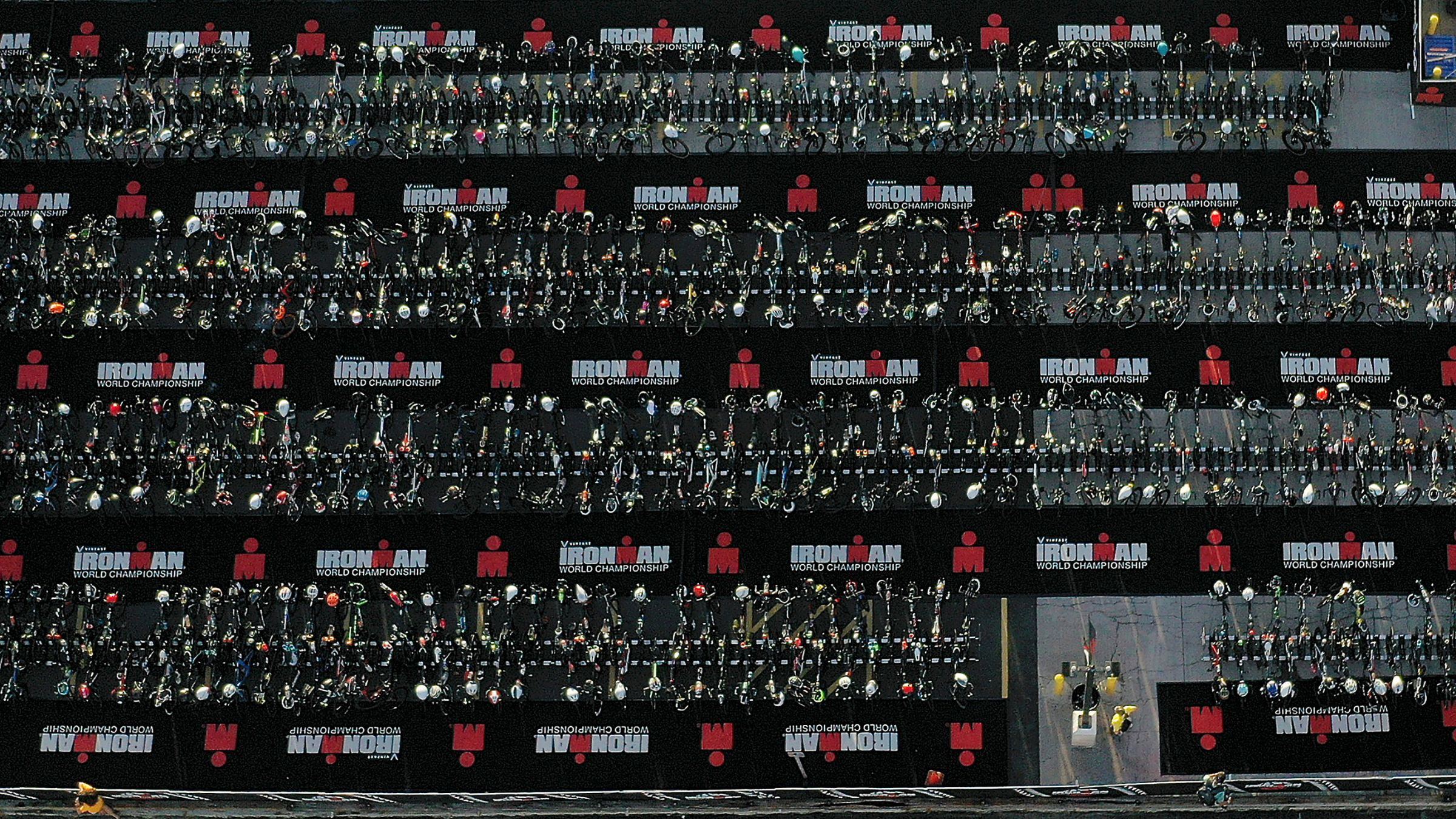

(Photo: Ezra Shaw/Getty Images for IRONMAN)

Each year (pandemic notwithstanding), dozens of bike industry professionals gather on the hot, sweaty pavement by the bike check in entrance in Kona, hoping to snag some shade under the banyan tree with a good view of the world’s best long-course triathletes checking in their gear. It’s hard work, and for better or worse, this year was historically hard with not only two days of racing—all women and some age-group men on the first day, remaining age-group men and pro men on day two—but also complicated by a second, pro-only transition area off the pier and onto Ali’i Drive.

While we’ve presented the raw bike count data here, the sweat equity these brave souls put into the count means we should be more diligent with their findings, as we now have over twice as many data points and—for the first time in memory—the pro count pulled out separately. First, we’ll take a look at the total data—all age groupers over both days of racing—then quickly at the men’s pro count data far below.

Want to see the full numbers from the 2022 Ironman Kona Bike Count? Go here: Cervélo Dominates The Hawaii Ironman World Championship 2022 Kona Bike Count

The Data

First off, it’s very important to note that in prior years we were dealing with roughly 2,400 athletes at the traditional Hawaii Ironman World Championships. The last year Hawaii hosted the world championships in 2019, there were 2,377 to be exact. This year, there were a total of 5,276 athletes according to Ironman’s early count. That’s well over double.

Furthermore, we also have another twist in the comparison with the unique data set from the Ironman World Championships earlier this year in St. George. Of course, it’s worth operating with one caveat up front when we look at the May data: The IMWC St. George data skewed very very North American, and while we like to think that the St. George race in May was “all of the best of the best in the world,” it probably wasn’t as a whole. Though there’s no way to quantify it, we were hearing that most international people who qualified (or had deferred slots) still preferred to race in Kona in October, rather than St. George in May. (Which makes sense since that was likely their dream/goal to begin with when they set out to qualify in the first place.)

Finally, it’s worth noting for accuracy that our list of brands has a quantity ceiling for inclusion—at least four in bikes, 11 in aerobars, 14 in wheels, and 15 in saddles in 2022. Historically too, we see about a 10-15% difference between the total amount counted of a category versus the total participants—some of this is due to the inclusion ceiling, some of it is due to human error in the process. Some of it boils down to people just using funky parts or frames or modifying them beyond recognition. Triathletes do like to tinker.

The Big Movers

One of the toughest things about looking at Kona bike count data typically is that things move fairly slowly. To glean any kind of takeaway, you usually have to dig in really deep and make some assumptions that feel a little more crystal ball than anything else (we won’t do that here), because typically changes happen pretty slowly. Triathletes—especially the top triathletes in the world don’t suddenly swap brands en masse. With one exception: when everyone suddenly starting wearing the Nike Vapor/NEXT/Alpha supershoes upon their release a few years ago. Otherwise changes are very slight year over year.

The exciting thing about this year’s bike count is it’s been three years since the last one (really), and while the May event is fun to look at, it’s definitely not an apples-to-apples comparison (as much as any of this truly can be).

The Bikes

First, and most obviously Canyon is charging up the rankings. Not only did Canyon move up three slots since 2019, but it’s the first brand to even be within striking distance of Cervelo’s dominance at a steady 20% of the share in recent memory.

For perspective, back in 2019, Canyon had 7.5% of the bikes (179) on the pier; in 2022 it had 14% (776). Canyon effectively doubled its share on the truly international field. (Tellingly, Canyon only had 7% of the share in St. George, maybe indicating a bigger trend overseas—or just one with higher-performance athletes.)

Behind Canyon’s big march to the front, a slight 1% slip from Trek is barely of interest from Kona to Kona, but Felt saw an almost 3% slip, moving back from the top three in 2019 to fifth in 2022. Oddly, Felt stayed neutral from Kona 2019 to St. George 2022 at around 7% of the share.

Further back, there was small movement forward in Cube (.97% up to 1.76%) and small movement backward in Ventum (1.81% to .87%), but at those small of numbers, change is not particularly statistically significant (if any of this truly is).

RELATED: The Best Triathlon Bikes, Updated for 2022

Aerobars and Components

In aerobars, we saw business as usual up front with Profile keeping about a quarter of the total field, while 3T slid back mightily from second in 2019 (and 12%) to fifth in 2022 (with 6%). Zipp also moved up in that category, coming in third and gaining 4% share in three years.

While components look to be fairly interesting on their face, due to the wide difference in components counted versus participants in 2022—and knowing the constant that truly 99% of Kona triathletes have either Shimano or SRAM—I’m not going to get into that comparison here. Other categories we can shrug away the margin of error with the “funky parts/modified parts” excuse, but that’s not historically been the case with components. So here, we’ll leave it alone.

Wheels

Wheels seems to be one of the biggest shakeups of all with Zipp seemingly bleeding share, coming in at 47% in 2022 versus a dominant 67% back in 2019. DT Swiss moved up very very fast in the wheel category with 28% of the field in 2022 versus 7% three years ago. In St. George, however, DT Swiss only moved up marginally with 12% of the field—again suggesting more international movement overall.

Both Enve and HED lost share—4% and 3% drop, respectively—but otherwise the top 15 stayed relatively stable, with the exception of Princeton coming in 11th in 2022, versus being entirely absent from the wheels that made the count cut in 2019.

RELATED: The Best Aftermarket Wheels For Triathletes (Updated 2022)

Saddles and Pedals

In saddles, ISM dropped by almost 6% share in three years, however there wasn’t much notable movement up top—except for the entrance of a few new brands like Gebiomized, and some movement upwards as a whole from brands like Prologo and Selle Italia, potentially diluting the bigger brands’ overall share.

Finally, pedals were of slight interest as Shimano and Look both lost overall share (5% and 6% respectively) over the super super fast-moving Favero powermeter pedals that went from an almost-insignificant 3% in 2019 to a very significant 15% share in 2022. Again, the jump is far less pronounced in the St. George count (7%), showing that Favero may have a much more international appeal. Powertap also took a substantial hit in the count, going from 5% in 2019 to barely registering in 2022 with 1.5% of the share. Elsewhere with Garmin and Speedplay, not much change at all.

RELATED: The Best Triathlon Saddles of 2022

The Pro Count

Very quickly, we’ll look at the pro count – specifically, the men’s count data, for simplicity’s sake – as an exercise, knowing that we don’t have previous numbers, and that the data is not only super small, but also not entirely based on choice (or based on choice at all). While many pros are likely “only riding X because they’re getting paid,” the reality is probably more of a mix. No pro is going to get to this level and choose to ride on something substantially sub-optimal just to make a few bucks, but they may be swayed slightly by either financial incentive or availability (i.e., Can I get it for free/cost and will it be ready on race day?)

Oddly, we see that the men’s bike percentages (again, taking into account a super-small data size and lots of causal factors at play) align quite closely to the overall age-group count: Cervelo has 20% in both, Canyon 12% (versus 14% for the age groupers), and Trek has 10%—basically the same as the age group share. That said, even one bike brand allegiance swap in the small pro field could have a huge impact on the overall percentage, as there’s a wide variety and a small data set.

Elsewhere, we see a consensus on the very cool (and very custom and very expensive) Drag2Zero aerobars that make up a full 18% of the count—versus an almost-nothing 2% of the age-group count. On the other hand, Zipp is vastly underrepresented in the pro field wheel count with 18% of the share versus their otherwise-dominant 47% in the age-group ranks. (Though of course it is worth noting that Zipp has been sliding fast.) HED is just the opposite with a big 20% of the men’s pro field and a very small 8% share for age groupers.

Finally, we see that the pros are leading the rising Gebiomized saddle trend on 22% of their bikes (the most of any brand), while ISM is disproportionately absent from the very wide variety of saddles in the pro field. Pedals are shockingly Shimano-and-Speedplay heavy—far more than what we see in the age group ranks. In fact, Look barely makes the cut with the pros, despite making up 21% of the age-group field.

So what can we take away from the new set of small-sample men’s bike count numbers? That there are a few trends where pros might be leading the way (Gebiomized saddles or Drag2Zero bars, for instance); there also might be a few instances where brands are more interested in working with pros (like HED or Speedplay/Wahoo, for example) or less interested (like Zipp, I’m guessing).